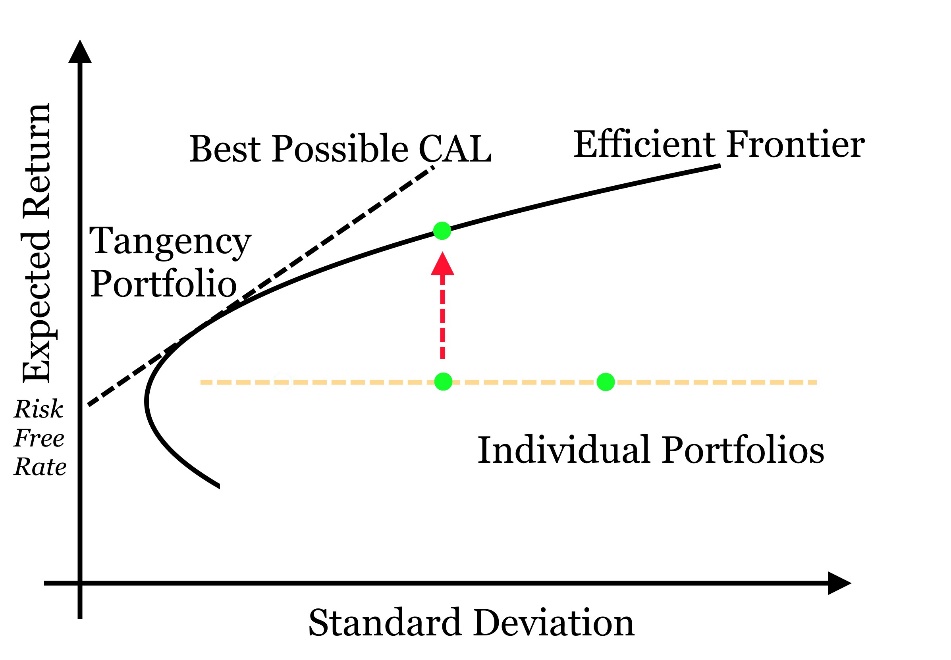

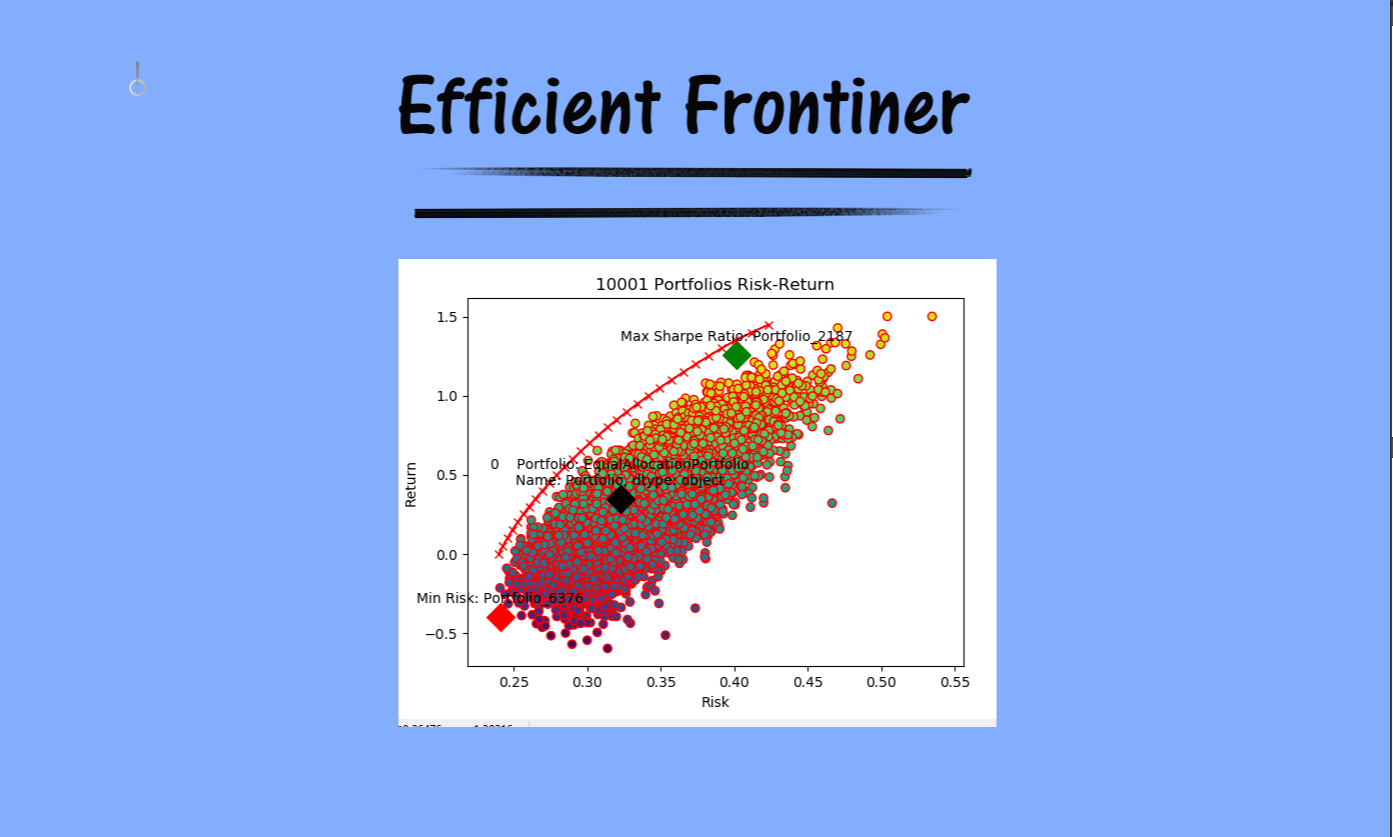

Understanding Efficient Frontier. The Nobel Prize Winner Theory To Gain… | by Farhad Malik | Towards Data Science

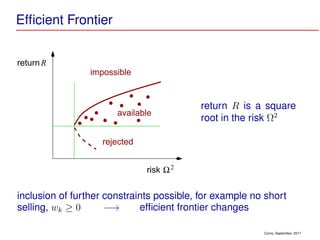

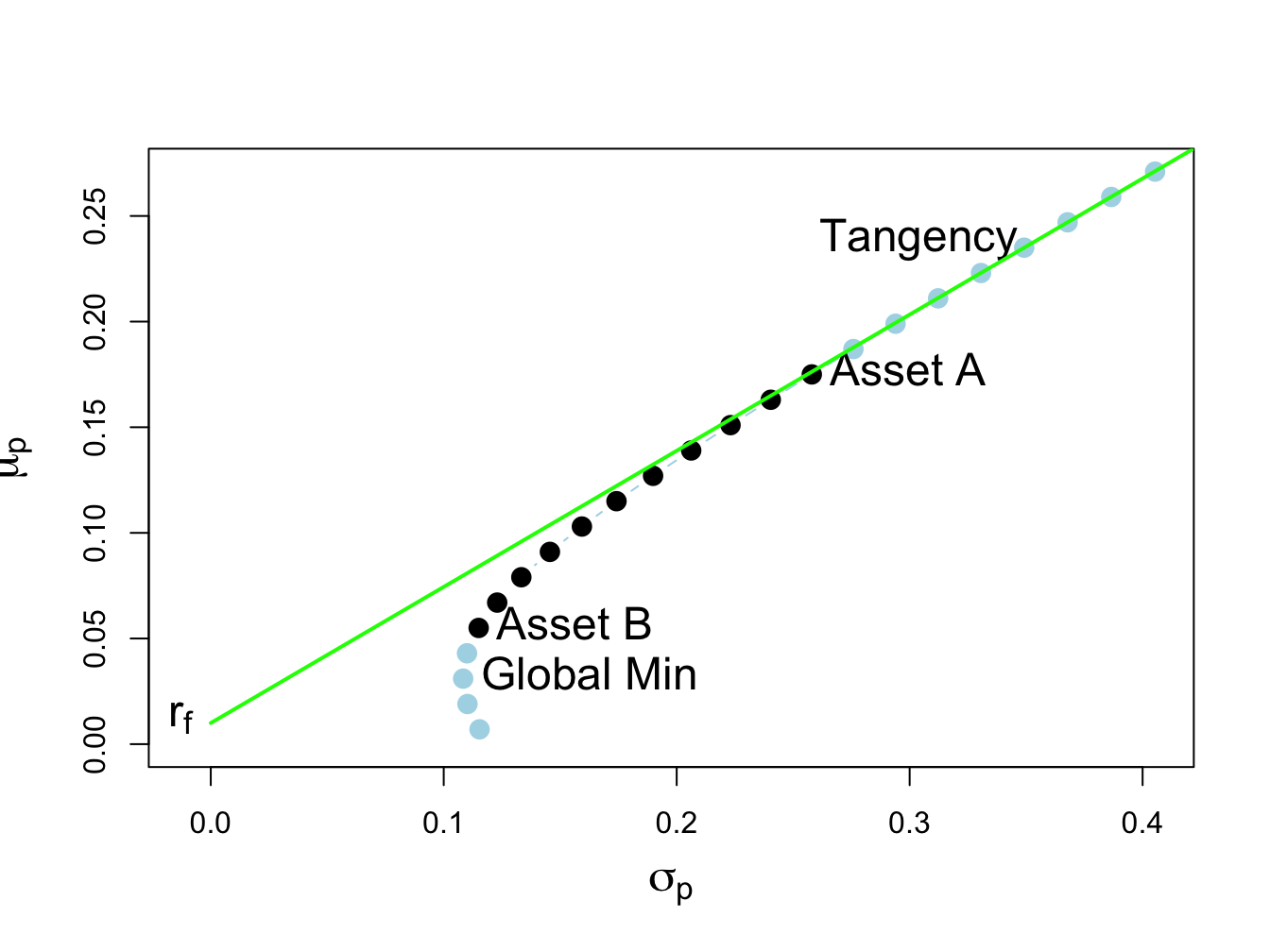

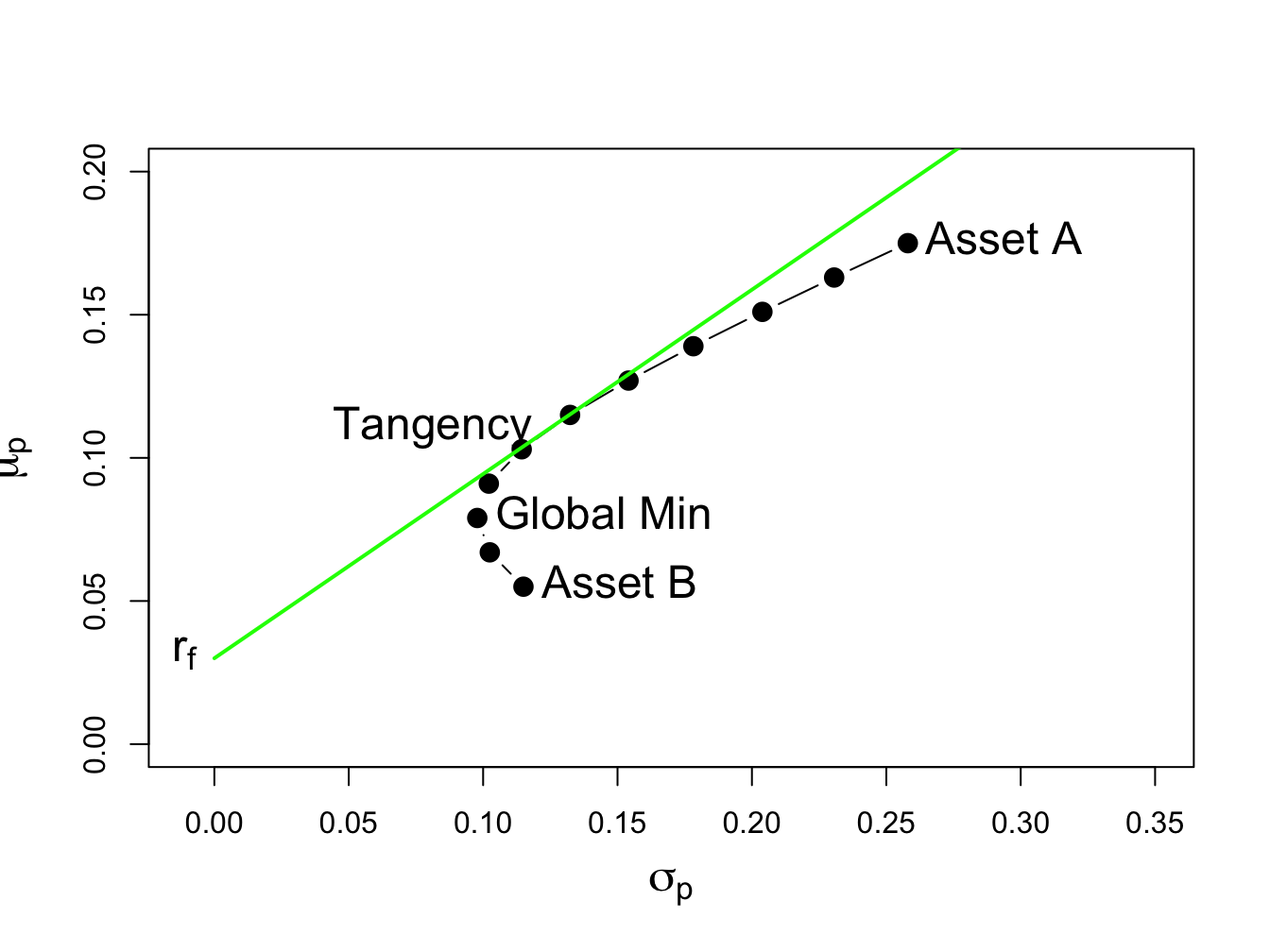

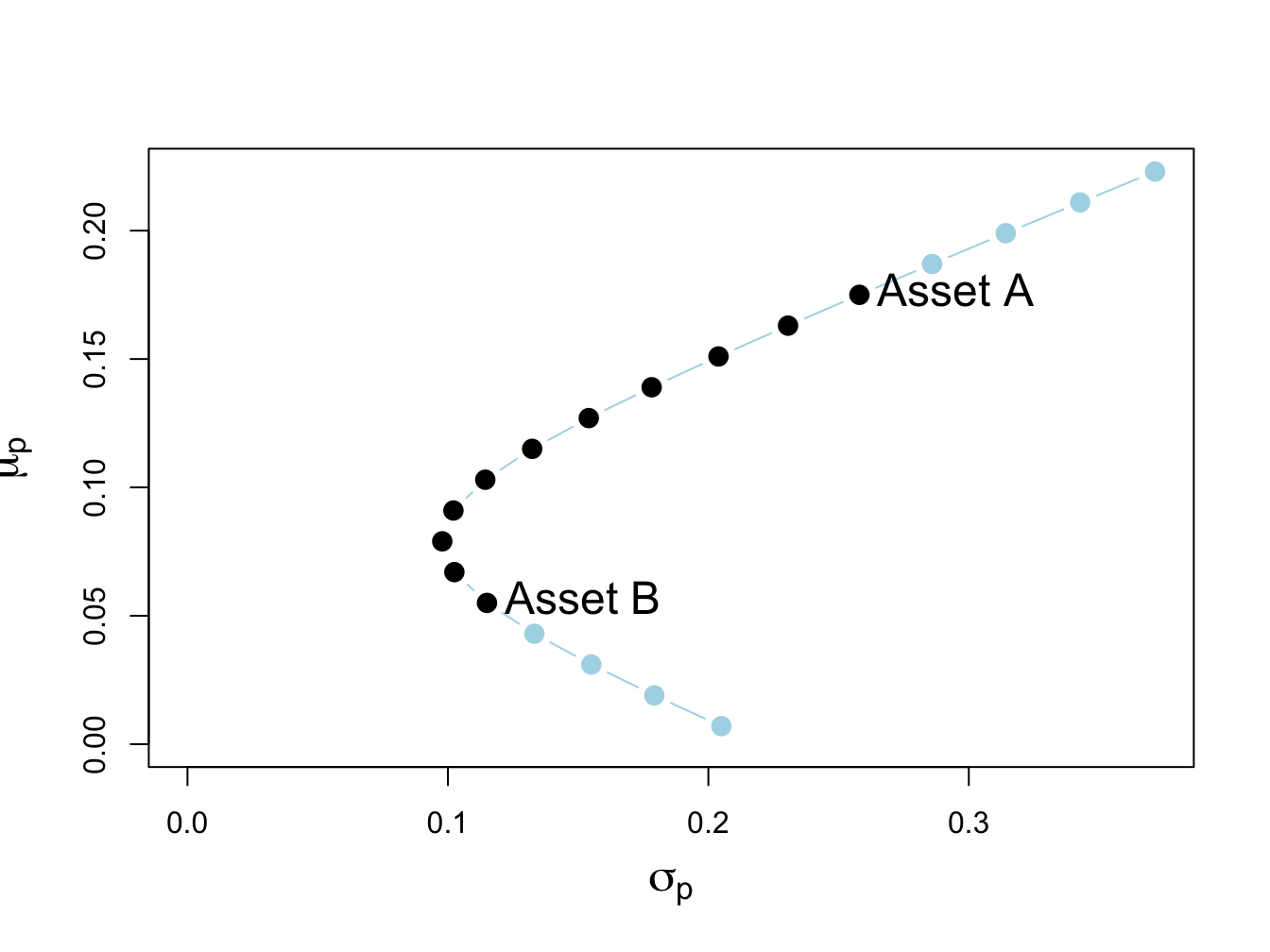

13 Portfolio Theory with Short Sales Constraints | Introduction to Computational Finance and Financial Econometrics with R

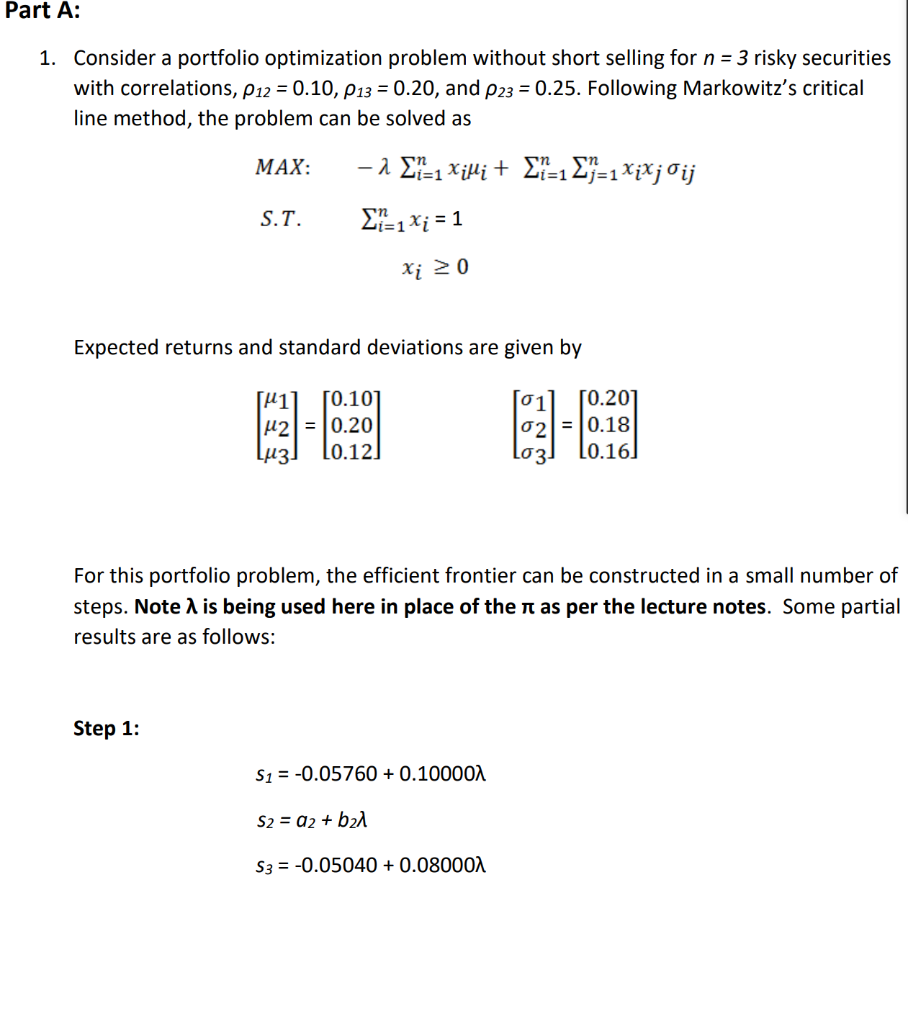

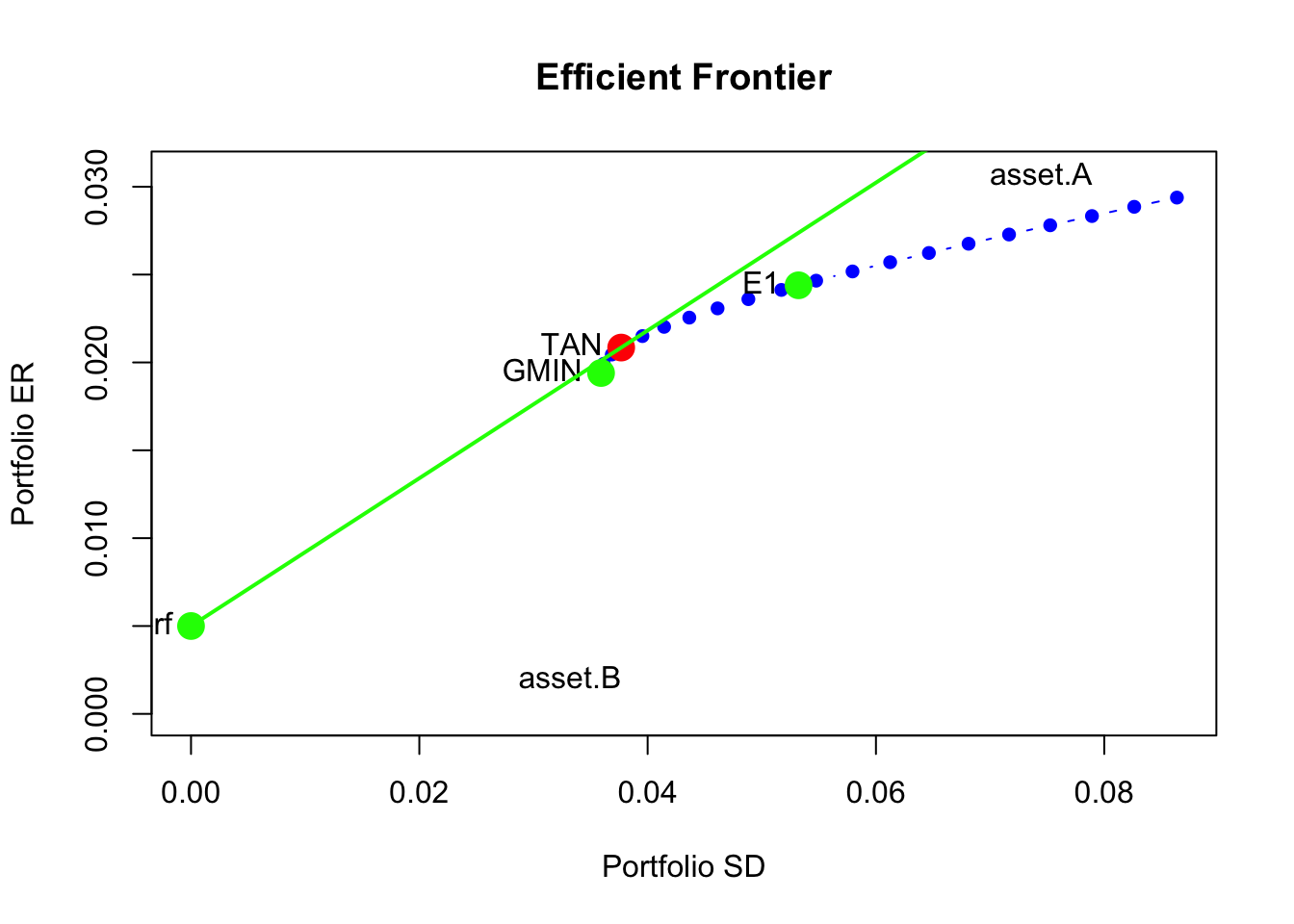

Efficient Frontier - Portfolio optimisation (optimization) with and without short-selling - File Exchange - MATLAB Central

13 Portfolio Theory with Short Sales Constraints | Introduction to Computational Finance and Financial Econometrics with R

13 Portfolio Theory with Short Sales Constraints | Introduction to Computational Finance and Financial Econometrics with R

PDF) The efficient frontier of the minimum-variance portfolio selection problems | Marius Radulescu - Academia.edu

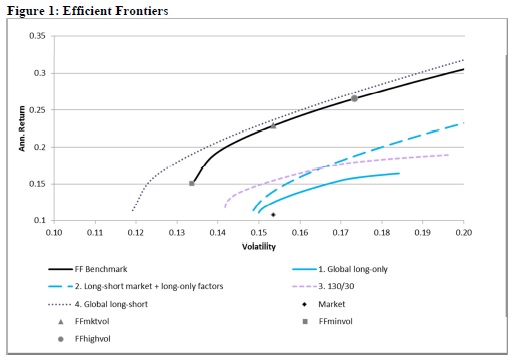

The efficient frontier for the ten assets with and without short sales... | Download Scientific Diagram

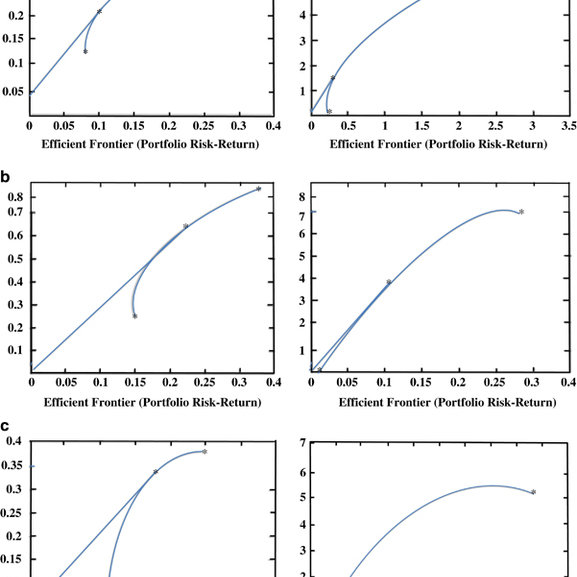

Efficient frontiers without short sales (on the left) and with short... | Download Scientific Diagram

Efficient frontiers without short sales (on the left) and with short... | Download Scientific Diagram

13 Portfolio Theory with Short Sales Constraints | Introduction to Computational Finance and Financial Econometrics with R

Efficient Frontier - Portfolio optimisation (optimization) with and without short-selling - File Exchange - MATLAB Central

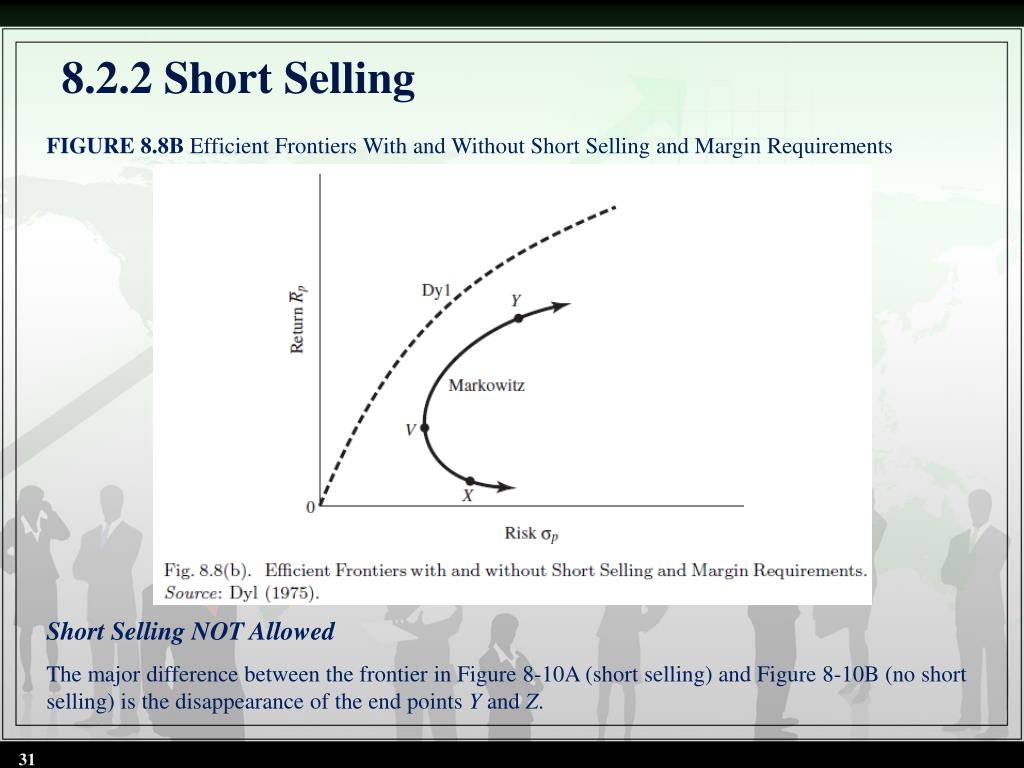

PPT - Chapter 8 Risk-Aversion, Capital Asset Allocation, and Markowitz Portfolio-Selection Model PowerPoint Presentation - ID:6776420